Local Law 153 of 2017 - Conversion of DOB-Issued ECB Judgments Into Property Lien

Background:

Under the Local Law 153 of 2017, enforcement of environmental control board judgments against owners for certain building code violations as shown below shall constitute a tax lien on the property named in the violation with respect to which such judgment was rendered.

A building code violation with respect to

(i)

a private dwelling, a wooden-framed single room occupancy multiple dwelling, or a dwelling with a legal occupancy of three or fewer dwelling units,

(ii)

a violation of section 28-210.1 involving the illegal conversion, maintenance or occupancy of three or more dwelling units than are legally authorized by the certificate of occupancy or if no certificate of occupancy is required as evidenced by official records,

(iii)

a building that contains twenty or more dwelling units, or that contains any space classified in an occupancy group other than occupancy group R, where the total value of all such judgments against such building is $60,000 or more, or

(iv)

a building that contains only space classified in occupancy group R and no fewer than six and no more than nineteen dwelling units, where the total value of all such judgments against such building is $30,000 or more.

Property Lien Conversion Process

1. DOB issues ECB Violations

2. OATH sends notice to required parties

3. Hearing Date – Defaulted / In Violation

4a. OATH entered the judgment in court and referred to DOF the unpaid judgments.

5a. ECB judgments converted to property lien 30 days later if they remained unpaid.

4b. DOF identifies the judgments eligible for lien conversion and sends a 30-day warning letter to property owners.

5b. Converted ECB judgments / property lien are shown on Property Tax bill.

1. DOB issues ECB Violations

DOB issued ECB violations against property owners when there was non-compliance with the NYC Building Code, the Zoning Resolution, the Electrical Code or other applicable rules and laws.

2. OATH sends notice to required parties.

Once the Office of Administrative Trials and Hearing (OATH) received the electronic record after the issuance of the ECB violation, OATH sent letters to required parties.

3. Hearing Date – Defaulted / In Violation

Whether (i) the respondents/property owners with the issued ECB violations attended the hearing on the date indicated on their summonses and were found in violation or (ii) they did not attend (in default), they still have time to resolve the debt before the unpaid violations are filed in court as judgments.

4a. OATH entered the judgment in court and referred to DOF the unpaid judgments.

Once judgments were referred to Department of Finance (DOF) for collection, DOF sent a 30-day warning letter to respondents/property owners with ECB judgments qualified for property lien conversion. If respondents/property owners resolved the qualified judgment debt within 30 days, the judgments would not be converted into property lien.

4b. DOF identifies the judgments eligible for lien conversion and sends a 30-day warning letter to property owners.

5a. ECB judgments converted to property lien 30 days later if they remained unpaid.

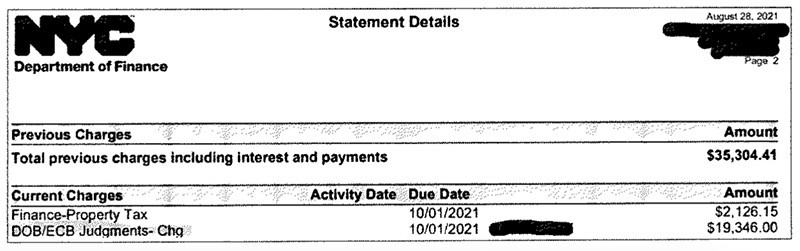

If respondents/property owners did not resolve the qualified judgment debt within 30 days, the judgments would be converted into property lien and shown as DOB/ECB Judgments charge on their property tax bill.

4b. DOF identifies the judgments eligible for lien conversion and sends a 30-day warning letter to property owners.

ECB Lien Conversion Summary

ECB Lien Conversion Start

First cohort of converted violations appeared on the FY21 3rd quarter property tax bill due on January 1, 2021.

ECB Lien Conversion Totals

Number of Properties

128

Number of Violations

533

Amount

$6,075,031